Nvidia (NVDA) has become nearly synonymous with the AI boom, powering everything from massive data center training clusters to the next generation of intelligent applications. Its latest earnings made one thing clear: “the age of AI is in full steam,” as CEO Jensen Huang said. He also highlighted that enterprises are now adopting agentic AI to transform workflows. Nvidia’s GPUs are enabling this shift toward more autonomous, decision-making systems, which many now call agentic AI, and that momentum is reshaping the entire chip ecosystem.

One company quietly sitting at the heart of that shift is Cadence (CDNS). It supplies the software and simulation engines chipmakers use to design, verify, and optimize the very processors that run agentic AI. By deepening partnerships with Nvidia, new AI-centric design platforms, and a growing project pipeline, Cadence positions itself to benefit if demand for complex AI chips keeps climbing.

For investors bullish on agentic AI and Nvidia’s roadmap, Cadence is a logical candidate to watch.

About Candace Stock

Cadence Design Systems is a market leader in electronic design automation and “AI and digital twins,” accelerating the engineering of next‑generation products from silicon to full systems. Cadence’s tools are used by the world’s top semiconductor and tech companies to build chips for cloud computing, 5G, AI, automotive, aerospace, and more.

Valued at $80 million by market cap, Cadence’s stock has had a bumpy year. Early 2025 worries about China export curbs weighed on shares, but once those eased, the business rebounded. Cadence itself noted, “China design activity remains very strong” as restrictions were lifted. The share price climbed into the summer, peaking near its all‑time high around $375 in mid‑September, driven by the Nvidia‑AI boom and China’s recovery. After the Q3 report, it dipped a bit, as if some of the rally was already priced in. Still, the stock is materially higher on the year. In short, Cadence is trading nearly flat year-to-date (YTD), reflecting strong growth offset by lofty expectations.

Despite the recent correction, CDNS's valuation is still notably high, with a P/E ratio of 48, almost double the sector average of 24, indicating it is considerably overpriced compared to its peers.

Nvidia’s AI Boom and Cadence’s Opportunity

Nvidia is doing a massive shift in computing. Huang described “foundation model makers” scaling up, demand for Nvidia’s new Hopper GPUs, and coming Blackwell chips as “incredible.” Crucially, Nvidia explicitly tied this to “agentic AI,” where systems autonomously plan and execute tasks. Agentic AI, as Nvidia defines it, uses sophisticated reasoning and iterative planning to solve multi-step problems. This means workloads like robotics, data center orchestration, and autonomous software are ramping up.

That trend is good news for Cadence. Every new GPU or AI chip design requires extensive verification and simulation, which is Cadence’s core business. In effect, Nvidia is calling out real-world AI applications (like digital “AI factories” and robots), and Cadence’s design tools are used to build those chips and systems. For example, at a recent event, Cadence unveiled a new “Millennium” supercomputer using Nvidia Blackwell GPUs to accelerate semiconductor design and simulation. It also announced a full‑stack “agentic AI” solution integrating Cadence’s JedAI platform with Nvidia’s NeMo AI framework, targeting things like conversational design assistants and AI‑driven circuit synthesis.

In practical terms, Cadence’s Q3 strength reflects this wave. All of its segments contributed to growth, and management raised guidance accordingly. The company is investing aggressively; it agreed to acquire Hexagon’s Design & Engineering unit to bolster its digital‑twin and simulation offerings, and it recently closed the purchase of Arm’s Artisan IP portfolio to capture more of the AI design ecosystem.

Looking forward, if Nvidia and others maintain brisk demand for new AI chips, Cadence should see continued robust sales as chipmakers leverage its software.

Cadence Beats Q3 Earnings

Cadence delivered another solid quarter. Revenue hit about $1.339 billion, up nearly 10% from a year ago. Net income rose to roughly $287 million, and EPS came in at $1.51, a strong jump from last year’s $1.64. All three business segments grew, and the company’s backlog climbed to a record $7 billion. Free cash flow also remained strong, with Cadence generating around $1.5 billion last year.

Management raised its guidance again. For Q4, the company expects EPS of roughly $1.20. For the full year, it now sees revenue in the $5.26 billion to $5.29 billion range, up about 14% from last year, along with EPS between $3.80 and $3.86. Analysts are on the same page, generally expecting around $5.25 billion in revenue and about $6.90 in EPS for 2025.

CEO Anirudh Devgan called the quarter “excellent,” pointing to broad strength across the business and the tailwind from Cadence’s growing AI partnerships. Overall, the company beat expectations and nudged its outlook higher.

What Analysts Say About CDNS Stock

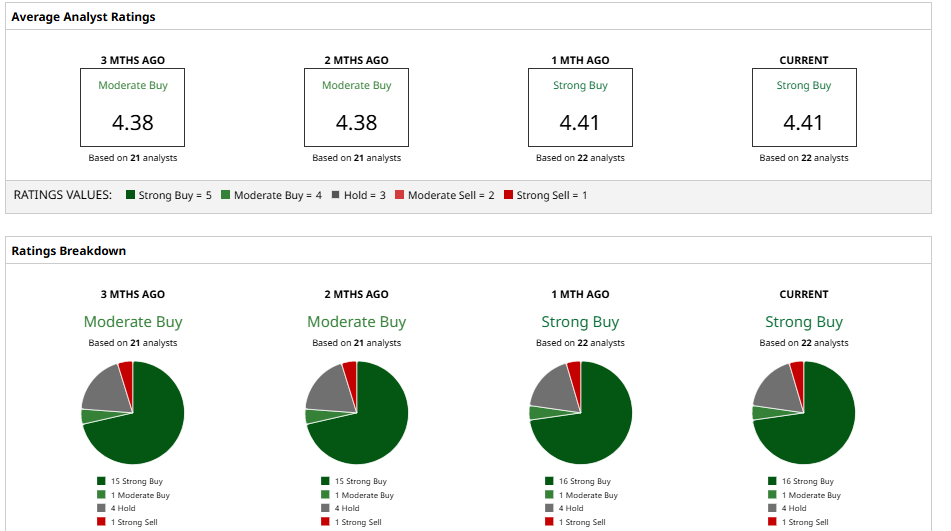

The Wall Street consensus is bullish. Barchart data shows a “Moderate Buy” consensus with a split of 16 “Strong Buy,” one “Moderate Buy,” four “Hold,” and one “Strong Sell.”

The average 12‑month price target is set at about $384, which means CDNS stock could climb up to 26% from the current price.

Separately, we have seen multiple firms raise their price targets in recent times. For instance, Goldman Sachs reaffirmed its “Buy” rating with a new $410 price target, up from $400, while Baird lifted its target to $418. Loop Capital is at $400, Wells Fargo is calling for $410, and J.P. Morgan sits at $405, all suggesting there’s still room for upside.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Highest-Yielding Dividend Aristocrats to Buy Today

- Watch These 3 Chart Indicators for Early Warning Signs That the Bull Market is Over

- JEPI, the Covered Call ETF That Started a Mania, Is a Fallen Star. Here’s What Comes Next.

- Tesla Is Looking for ‘Exceptional Ability’ in AI Chips. Does That Make TSLA Stock a Buy Here?