As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the healthcare technology for providers industry, including Privia Health (NASDAQ:PRVA) and its peers.

The healthcare technology sector provides software and data analytics to help hospitals and clinics streamline operations and improve patient outcomes, often through value-based care models. Future growth is expected as providers prioritize digital transformation to manage rising costs and patient demands. Tailwinds include the adoption of AI-driven tools and government incentives for digitization. There challenges as well, including long sales cycles and slow adoption by providers, who may be resistance to change. Tightening hospital budgets and cybersecurity threats are additional risks that could slow adoption.

The 5 healthcare technology for providers stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 4.8% while next quarter’s revenue guidance was 0.9% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.2% since the latest earnings results.

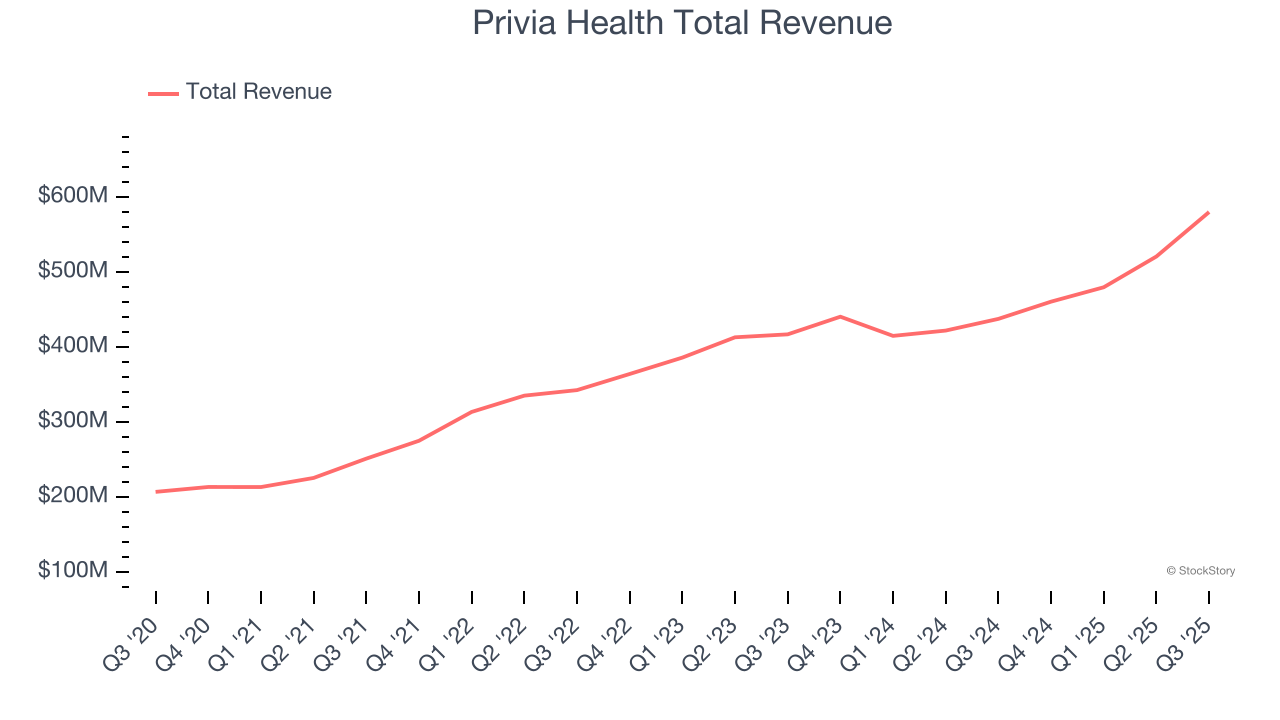

Best Q3: Privia Health (NASDAQ:PRVA)

Operating in 13 states and the District of Columbia with over 4,300 providers serving more than 4.8 million patients, Privia Health (NASDAQ:PRVA) is a technology-driven company that helps physicians optimize their practices, improve patient experiences, and transition to value-based care models.

Privia Health reported revenues of $580.4 million, up 32.5% year on year. This print exceeded analysts’ expectations by 16.6%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS and revenue estimates.

Privia Health pulled off the biggest analyst estimates beat but had the weakest full-year guidance update of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 1.8% since reporting and currently trades at $24.56.

Is now the time to buy Privia Health? Access our full analysis of the earnings results here, it’s free for active Edge members.

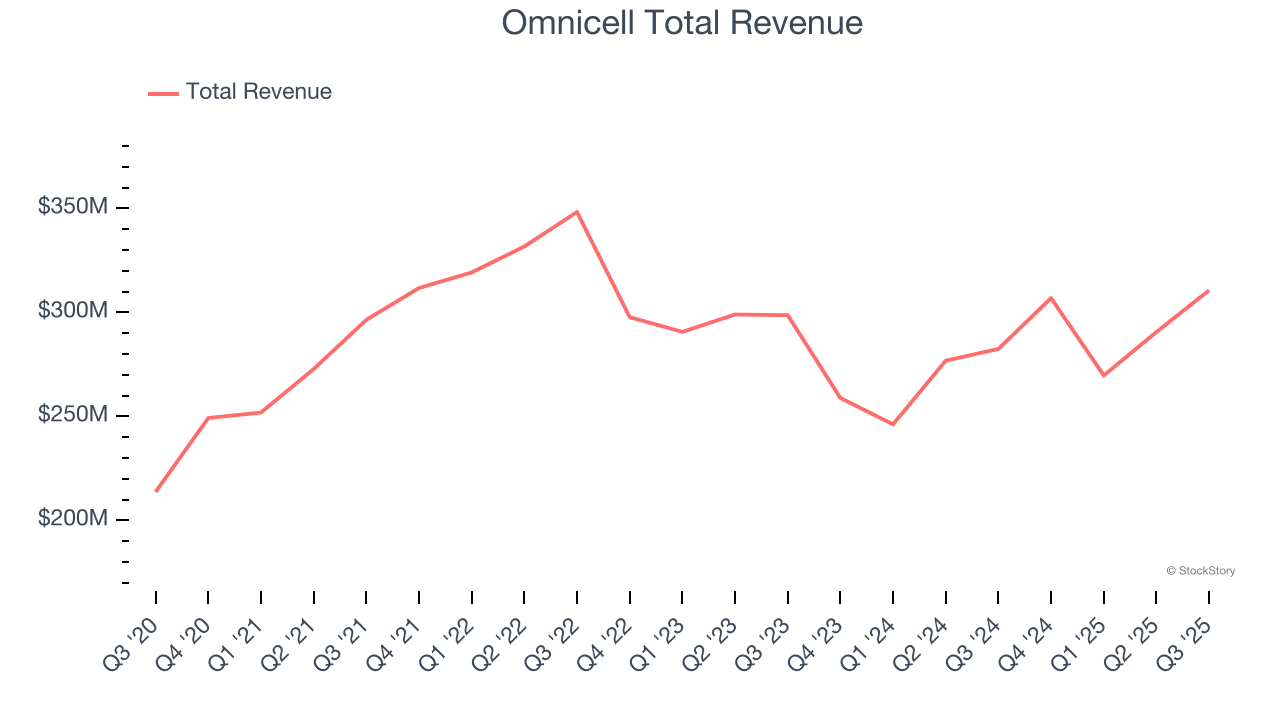

Omnicell (NASDAQ:OMCL)

Driven by the vision of an "Autonomous Pharmacy" with zero medication errors, Omnicell (NASDAQ:OMCL) provides medication management automation and adherence tools that help healthcare systems and pharmacies reduce errors and improve efficiency.

Omnicell reported revenues of $310.6 million, up 10% year on year, outperforming analysts’ expectations by 5%. The business had a very strong quarter with a beat of analysts’ EPS and revenue estimates.

The market seems happy with the results as the stock is up 21.4% since reporting. It currently trades at $35.90.

Is now the time to buy Omnicell? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Astrana Health (NASDAQ:ASTH)

Formerly known as Apollo Medical Holdings until early 2024, Astrana Health (NASDAQ:ASTH) operates a technology-powered healthcare platform that enables physicians to deliver coordinated care while successfully participating in value-based payment models.

Astrana Health reported revenues of $956 million, up 99.7% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates and full-year revenue guidance missing analysts’ expectations.

As expected, the stock is down 31.5% since the results and currently trades at $22.85.

Read our full analysis of Astrana Health’s results here.

Evolent Health (NYSE:EVH)

Founded in 2011 to transform how healthcare is delivered to patients with complex needs, Evolent Health (NYSE:EVH) provides specialty care management services and technology solutions that help health plans and providers deliver better care for patients with complex conditions.

Evolent Health reported revenues of $479.5 million, down 22.8% year on year. This print topped analysts’ expectations by 2.6%. However, it was a slower quarter as it produced a significant miss of analysts’ EPS estimates and EBITDA guidance for next quarter missing analysts’ expectations significantly.

Evolent Health achieved the highest full-year guidance raise but had the slowest revenue growth among its peers. The stock is down 29.1% since reporting and currently trades at $4.25.

Read our full, actionable report on Evolent Health here, it’s free for active Edge members.

Premier (NASDAQ:PINC)

Operating one of the largest healthcare group purchasing organizations in the United States with over 4,350 hospital members, Premier (NASDAQ:PINC) is a technology-driven healthcare improvement company that helps hospitals, health systems, and other providers reduce costs and improve clinical outcomes.

Premier reported revenues of $240 million, down 3.3% year on year. This result lagged analysts' expectations by 1%. More broadly, it was a mixed quarter as it also recorded a beat of analysts’ EPS estimates but a slight miss of analysts’ revenue estimates.

Premier had the weakest performance against analyst estimates among its peers. The stock is flat since reporting and currently trades at $28.26.

Read our full, actionable report on Premier here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.