TransCanada Corporation (TRP)

64.20

-0.59 (-0.91%)

NYSE · Last Trade: Mar 4th, 7:43 PM EST

CALGARY — The era of artificial intelligence has moved from silicon chips to steel pipes and nuclear reactors. On February 13, 2026, North America’s two largest midstream energy giants, Enbridge Inc. (NYSE: ENB) and TC Energy Corp. (NYSE: TRP), reported blockbuster fourth-quarter earnings for 2025 that blew past Wall Street

Via MarketMinute · February 13, 2026

TC Energy (TRP) shows a strong technical uptrend with a high-grade bull flag setup, suggesting a potential breakout entry point for traders.

Via Chartmill · December 20, 2025

Global financial markets are currently grappling with a significant and sustained decline in crude oil prices, a phenomenon that has intensified throughout 2024 and 2025. As of December 16, 2025, both Brent and West Texas Intermediate (WTI) crude oil benchmarks have plunged to near five-year lows, with WTI trading around

Via MarketMinute · December 16, 2025

The global oil market is currently gripped by a pervasive bearish sentiment, as traders increasingly position themselves for an anticipated and significant oil glut expected to dominate market dynamics through 2026 and potentially beyond. This outlook is deeply informed by a confluence of surging global supply and moderating demand, with

Via MarketMinute · November 25, 2025

Washington D.C. – November 19, 2025 – The latest Federal Open Market Committee (FOMC) Minutes, released today, have unveiled a deeply fractured Federal Reserve, with policymakers expressing "strongly differing views" on the future trajectory of interest rates. This internal discord, particularly concerning a potential December interest rate cut, has injected a

Via MarketMinute · November 19, 2025

AI boom is accelerating US energy transition towards natural gas, as soaring power demand from data centers shifts focus away from renewables.

Via Benzinga · November 13, 2025

Calgary, AB – The North American energy infrastructure sector is buzzing with renewed optimism, underscored by the impressive performance of AltaGas (TSX:ALA), a diversified energy infrastructure company, which has recently moved decisively above crucial technical and fundamental thresholds. This significant upward trajectory, marked by a year-to-date stock rise of over

Via MarketMinute · October 14, 2025

In a financial landscape often characterized by volatility, Enbridge Inc. (NYSE: ENB), North America's premier energy infrastructure company, recently underscored its commitment to shareholder returns by declaring its latest quarterly dividend of $0.9425 per common share. This announcement, made on July 29, 2025, for payment on September 1, 2025,

Via MarketMinute · October 13, 2025

CALGARY, AB – October 6, 2025 – Enbridge Inc. (TSX: ENB, NYSE: ENB), a North American energy infrastructure titan, continues to project unwavering dividend consistency, a cornerstone of its appeal to income-focused investors. This steadfast outlook is largely attributed to the company's robust financial management and its strategic position as a significant

Via MarketMinute · October 6, 2025

TC Energy (TRP) shows a strong technical setup with an 8/10 rating, trading near 52-week highs. A 9/10 Setup Rating indicates a tight consolidation, signaling a potential bullish breakout above $52.08 resistance.

Via Chartmill · September 11, 2025

Toronto, ON – As of early October 2025, the Canadian financial landscape is witnessing a remarkable surge, largely orchestrated by the robust performance of its materials sector. Anchored by soaring gold prices and a resilient commodities market, this vital segment of the economy is not merely contributing but actively driving the

Via MarketMinute · October 1, 2025

The Liberal Prime Minister said his government will also back a proposed C$16.5 billion ($12 billion) carbon capture and storage project for Alberta’s oil sands.

Via Stocktwits · July 7, 2025

Exploring TC ENERGY CORP's Technical Signals and Breakout Potential: Based on good technical signals, TC ENERGY CORP is potentially setting up for a breakout.

Via Chartmill · May 7, 2025

TC Energy Corp (TRP) operates natural gas, oil, and power generation assets in Canada and the United States. TC Energy’s share price increased about 16.5% in the past year from $39.78 to $46.34 as of Wednesday’s market close.

Via Talk Markets · March 6, 2025

Donald Trump placing tariffs on Canada, China and Mexico could impact multiple sectors. A look at the areas where Americans could see higher prices soon.

Via Benzinga · February 3, 2025

Via Benzinga · January 15, 2025

Donald Trump continued his crusade for more tariffs from trade partners with the announced creation of the External Revenue Service.

Via Benzinga · January 14, 2025

Trudeau announces resignation after 10 years as Canadian Prime Minister. Political turmoil may impact U.S.-traded stocks of Canadian companies.

Via Benzinga · January 6, 2025

Donald Trump's plan for 25% tariffs could put Canada stocks and ETFs under pressure.

Via Benzinga · December 3, 2024

Elections have consequences. The results this time will likely have a profound impact on investors. The trick following every election is deciding what consequences are worth betting on.

Via Talk Markets · November 16, 2024

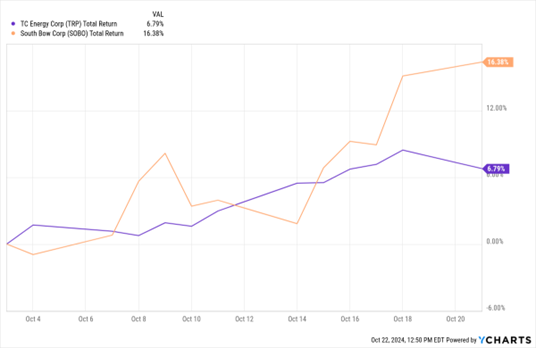

It’s been a few weeks since TC Energy Corp. (TRP) spun off its oil and liquids pipeline operations as a new company, South Bow Corp. (SOBO). We think there’s more outperformance ahead for both South Bow and post-spin TC Energy.

Via Talk Markets · November 2, 2024